Introduction

Exness has established itself as a well-recognized and highly regarded broker in the forex trading industry, catering to a wide range of traders across the globe. Since its foundation in 2008, Exness has gained popularity for its user-friendly platforms, competitive spreads, and strong regulatory framework. With a focus on providing a seamless trading experience, Exness is equipped with various tools and account types designed to meet the needs of beginners and professional traders alike.

Awards and Achievements

Exness has received numerous awards and accolades over the years, attesting to its commitment to innovation, transparency, and exceptional customer service. Some notable awards include the Best Global Forex Broker and Most Transparent Forex Broker from industry-recognized institutions. Exness’s transparency and technological advancements have positioned it as a reputable player in the forex market. These achievements highlight Exness’s dedication to providing an exceptional trading experience and maintaining high standards of service for its clients.

Pros and Cons

1. Pros:

- Strong Regulation: Regulated by reputable authorities, including the FCA and CySEC, providing a secure trading environment.

- Low Spreads and Fees: Exness offers competitive spreads, often lower than many other brokers in the industry.

- Wide Range of Trading Instruments: Access to forex, commodities, indices, and cryptocurrencies.

- User-Friendly Platforms: Available on MT4, MT5, and a proprietary platform for enhanced flexibility.

- 24/7 Customer Support: Offers multilingual support around the clock, which is beneficial for global traders.

2. Cons:

- Limited Educational Resources: Although Exness has some educational materials, it could improve in this area for beginner traders.

- Restricted Availability: Exness is not available in certain regions, which limits its accessibility for some traders.

- Withdrawal Fees on Certain Methods: While some payment methods are free, others may incur a fee depending on the region and currency.

Regulation and Security

Exness operates under a strong regulatory framework, adhering to the stringent standards set by multiple reputable financial authorities. This commitment to regulation ensures that Exness maintains a transparent and secure environment for its clients, building a foundation of trust within the trading community.

1. Regulatory Bodies

Exness is regulated by some of the most respected regulatory bodies in the financial world, including:

- Financial Conduct Authority (FCA) in the UK: As one of the most reputable financial regulators globally, the FCA enforces strict requirements on brokers under its jurisdiction. For Exness, this means adhering to protocols designed to protect client funds and ensure transparency in trading practices.

- Cyprus Securities and Exchange Commission (CySEC): In Europe, Exness operates under CySEC, which mandates high standards of financial reporting, risk management, and transparency. Compliance with CySEC allows Exness to serve European clients while adhering to the European Union’s regulatory standards.

- Financial Services Authority (FSA) of Seychelles and Financial Sector Conduct Authority (FSCA) of South Africa: These additional regulatory bodies enable Exness to serve clients across other global regions, ensuring local compliance and providing a regulatory safeguard in multiple jurisdictions.

2. Security Measures and Client Fund Protection

To further guarantee the safety of traders’ funds and personal information, Exness has implemented advanced security protocols:

- Client Fund Segregation: Exness keeps all client funds in segregated accounts, meaning that client money is held separately from the company’s operational funds. This practice is mandated by regulatory standards and is crucial in ensuring that client funds are not at risk in the event of any financial instability within the brokerage.

- Negative Balance Protection: Exness provides negative balance protection for all accounts, meaning that traders cannot lose more than their initial investment. This is particularly beneficial for new traders who are just learning the ropes, as it adds a layer of financial safety against extreme market volatility.

- SSL Encryption and Two-Factor Authentication: Exness employs SSL encryption to protect user data and prevent unauthorized access to accounts. Additionally, two-factor authentication (2FA) is available, enhancing account security by requiring an additional verification step during logins. These measures ensure that personal information and financial transactions are safe from potential cyber threats.

- Regular Audits: Exness conducts regular financial audits by third-party firms to ensure accuracy and transparency in its operations. These audits validate the broker’s financial practices, confirming adherence to regulatory standards and providing an additional layer of trust for traders.

- Compensation Scheme Participation: Exness is a member of investor compensation schemes, such as the Investor Compensation Fund (ICF) in Cyprus, which safeguards client funds up to a certain limit in the rare event of a broker insolvency. This compensation scheme adds an extra layer of security, reassuring traders that their capital is protected even in unforeseen situations.

3. Commitment to Transparency

One of Exness’s distinguishing factors in the industry is its commitment to transparency. Unlike many brokers, Exness publishes financial reports on its website, allowing clients to view its trading volume, client funds, and other key financial indicators. This level of transparency is rare in the brokerage industry and fosters trust, as traders can review the company’s performance and verify its claims.

4. Secure Trading Environment

Exness prioritizes creating a secure environment that supports both novice and experienced traders. Through rigorous regulatory compliance, advanced security protocols, and a commitment to transparency, Exness has established itself as a trusted broker in the financial industry. Its dedication to client fund protection and information security not only meets regulatory requirements but also aligns with industry best practices, setting a high standard in the online trading world.

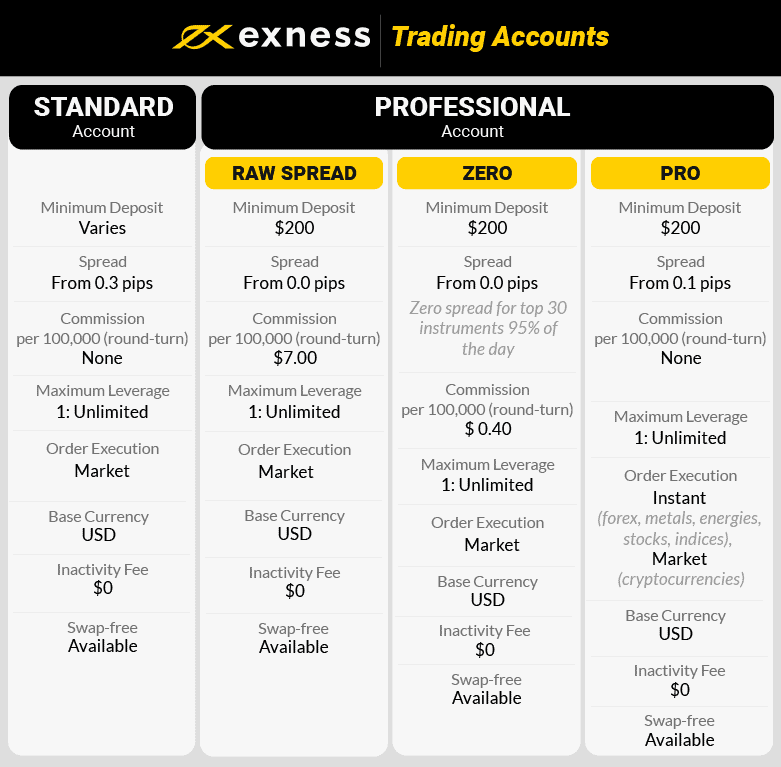

Account Types and Features

Exness offers a variety of account types designed to cater to different trading styles, experience levels, and investment goals. Each account type has unique features that meet the diverse needs of traders, from beginners testing the waters to professionals seeking advanced trading conditions. Here’s a closer look at each account type and the features they offer:

1. Standard Account

The Standard Account is the most accessible and beginner-friendly option available on Exness. It offers straightforward trading conditions, making it ideal for those new to the forex market or for traders who prioritize low-cost trading without additional fees.

- Spreads: The Standard Account provides competitive spreads starting as low as 0.3 pips, which allows for cost-efficient trading.

- Commission: This account is commission-free, allowing traders to focus purely on trading without worrying about additional charges.

- Minimum Deposit: The account has a low minimum deposit requirement, making it accessible to new traders with limited capital.

- Leverage: Flexible leverage options up to 1:2000 are available (depending on the region), allowing traders to maximize their potential returns on smaller investments.

- Access to MT4 and MT5: Traders on the Standard Account can choose to trade on MetaTrader 4 (MT4) or MetaTrader 5 (MT5), both of which offer robust charting tools and ease of use.

This account type balances simplicity and affordability, making it a great starting point for those looking to familiarize themselves with forex trading.

2. Standard Cent Account

The Standard Cent Account is tailored for beginners and those who prefer to test strategies with minimal risk. This account type operates on “cents” rather than dollars, so traders can make smaller trades without risking large amounts of capital.

- Cent-Based Trading: All trades are conducted in cents, which allows for smaller lot sizes and risk control.

- Spreads and Commission: Like the Standard Account, the Standard Cent Account also offers competitive spreads and is free of commission.

- Minimum Deposit: The minimum deposit requirement is extremely low, making it easy for new traders to enter the market.

- Leverage: High leverage options are available, similar to the Standard Account.

- Platform Availability: The Standard Cent Account can be accessed on MT4, which is beginner-friendly and widely used in the industry.

This account is particularly suitable for traders who want to practice live trading or test strategies in real-market conditions without significant capital exposure.

3. Raw Spread Account

The Raw Spread Account is designed for experienced traders who require ultra-low spreads, particularly beneficial for scalping and high-frequency trading. With spreads as low as 0.0 pips, this account provides an attractive option for those who prioritize tight spreads and precision.

- Spreads: The account offers raw spreads starting at 0.0 pips on major currency pairs, which is advantageous for traders who rely on small price movements.

- Commission: To compensate for the low spreads, a small commission is applied to each trade, providing a transparent and predictable cost structure.

- Minimum Deposit: A higher minimum deposit is required compared to the Standard accounts, which aligns with its focus on professional trading.

- Leverage: High leverage is available, but Exness recommends caution due to the increased risk that comes with trading on such tight spreads.

- Platform Access: Available on both MT4 and MT5, giving traders access to advanced trading tools and analytical capabilities.

This account type is popular among scalpers and day traders who require precision and minimal price fluctuation to optimize their strategies.

4. Zero Account

The Zero Account is designed for traders who seek the absolute tightest spreads, often going as low as 0.0 pips on over 30 currency pairs. This account type combines ultra-low spreads with a flexible commission structure, making it suitable for professional traders with a clear understanding of cost and volume.

- Spreads: Offers spreads as low as 0.0 pips, particularly attractive for high-frequency traders.

- Commission: A fixed commission is charged per lot traded, and this rate may vary based on the currency pair and trading volume. The fixed commission structure allows traders to calculate trading costs accurately.

- Minimum Deposit: A higher minimum deposit requirement is set to ensure this account suits experienced traders who can handle the account’s tighter trading conditions.

- Leverage: Like the Raw Spread Account, high leverage is available, though traders are advised to use it carefully.

- Platform Compatibility: Traders can use both MT4 and MT5, allowing flexibility in terms of tools and trading options.

The Zero Account is perfect for seasoned traders who want to capitalize on minuscule price differences and who rely on tight cost control for optimal profitability.

5. Pro Account

The Pro Account is Exness’s premium account option, catering to advanced and institutional-level traders who demand premium trading conditions. The Pro Account has the advantage of offering a commission-free structure combined with low spreads, creating a unique combination for traders who deal with larger volumes and seek a straightforward pricing model.

- Spreads: Spreads start at 0.1 pips, ensuring low trading costs while maintaining a commission-free structure.

- Commission: The Pro Account is commission-free, making it suitable for traders who prefer not to deal with additional fees beyond the spread.

- Minimum Deposit: Requires a substantial minimum deposit, which aligns with its target market of professional and high-volume traders.

- Leverage: As with other Exness accounts, high leverage is available, but Exness recommends that traders understand the associated risks.

- Platform Support: The Pro Account is accessible on both MT4 and MT5, providing access to a complete suite of advanced trading tools and indicators.

The Pro Account is ideal for professional traders and institutions that require high liquidity, low spreads, and a commission-free trading environment.

Additional Account Features

Aside from the specific benefits of each account type, Exness provides several shared features across all accounts to enhance the trading experience:

- Free Demo Accounts: Exness offers demo accounts on all platforms, allowing traders to practice and test strategies without risking real funds. This feature is particularly valuable for beginners who want to get a feel for the markets and the Exness trading environment.

- Swap-Free Options: Exness accommodates Islamic traders by offering swap-free accounts that comply with Sharia law, available on request for all account types.

- Flexible Leverage: Depending on regulatory restrictions and the trader’s location, Exness offers flexible leverage of up to 1:2000 or even higher in some cases. This high leverage option can be beneficial for traders looking to increase their buying power, but it also requires a solid risk management strategy.

- Order Execution Speed: Exness is known for its fast order execution times, which is a significant advantage for scalpers and high-frequency traders who rely on precision and speed to capture market opportunities.

- Risk Management Tools: Exness provides advanced risk management tools, such as stop-loss, take-profit, and negative balance protection, which help traders protect their capital and manage risk effectively.

Platforms and Trading Tools

Exness offers a variety of trading platforms and tools designed to accommodate both novice and experienced traders. By supporting industry-leading software like MetaTrader 4 and MetaTrader 5, as well as its proprietary Web Terminal, Exness provides flexibility and choice in trading options. Each platform is equipped with advanced tools, charting capabilities, and analytical features, allowing traders to navigate the forex market confidently and efficiently.

1. MetaTrader 4 (MT4)

MetaTrader 4 (MT4) is one of the most popular and widely used trading platforms in the industry, known for its stability and comprehensive set of features. Exness’s MT4 platform caters to both beginner and experienced traders, offering a reliable and easy-to-use trading experience.

- Charting and Technical Analysis: MT4 provides an array of customizable chart types, with nine timeframes to choose from, allowing traders to conduct in-depth market analysis. It includes 30 built-in technical indicators, such as moving averages, RSI, and MACD, essential for creating and testing trading strategies.

- Automated Trading: The platform supports Expert Advisors (EAs), which enable automated trading based on pre-set criteria. Traders can develop, backtest, and apply EAs to automate trading decisions, making it suitable for those who use algorithmic trading.

- Order Types and Execution Options: MT4 offers a variety of order types, including market, pending, and stop orders, providing traders with flexibility in trade management. The platform is also known for its fast execution speeds, which is critical for strategies like scalping.

- Accessibility: MT4 is available on desktop, mobile, and web versions, ensuring traders have access to the market from anywhere and at any time.

2. MetaTrader 5 (MT5)

MetaTrader 5 (MT5) is an advanced trading platform that builds on the foundation of MT4, offering more robust features and analytical tools for traders who need additional depth in their trading.

- Enhanced Analytical Tools: MT5 provides access to 21 timeframes and an expanded range of indicators and graphical objects, allowing for more granular analysis and detailed technical studies. This added versatility is ideal for traders who engage in multi-asset trading and require a more sophisticated analytical setup.

- Extended Order Types: MT5 includes additional order types, such as Buy Stop Limit and Sell Stop Limit, which offer more precise control over entry and exit points. This flexibility is especially beneficial for advanced traders using complex strategies.

- Economic Calendar: Integrated within MT5, the economic calendar provides real-time updates on economic events, interest rates, and important financial data releases, giving traders immediate access to information that can impact market conditions.

- Depth of Market (DOM): The DOM feature displays the liquidity and volume levels for an asset, allowing traders to assess the supply and demand of instruments more accurately. This tool is particularly valuable for high-frequency and volume traders.

- Multi-Asset Trading: MT5 supports trading across a broader range of instruments, including forex, commodities, indices, stocks, and cryptocurrencies, making it a versatile platform for traders looking to diversify their portfolios.

3. Exness Web Terminal

The Exness Web Terminal is a proprietary trading platform that can be accessed directly from a web browser without requiring downloads or installations. It’s a convenient option for traders who prioritize ease of use and accessibility.

- User-Friendly Interface: The Web Terminal is designed with simplicity in mind, providing a streamlined and intuitive interface that’s easy to navigate. It’s particularly suitable for beginners who are looking for a hassle-free trading experience.

- Quick Access to Key Features: Traders can easily place orders, manage positions, and access essential trading features, such as charting tools and technical indicators, all in one place. The platform also supports multiple languages, making it accessible to traders globally.

- Secure Web-Based Trading: The Web Terminal is SSL-encrypted, ensuring that all transactions and data are secure, even when accessed through different devices and networks.

- Compatibility: The Web Terminal is compatible with most major web browsers, enabling traders to access their accounts and execute trades from any internet-connected device, whether it’s a desktop, laptop, or tablet.

Advanced Trading Tools

In addition to robust platforms, Exness offers a suite of advanced trading tools that enhance the trading experience and support strategic decision-making.

- Autochartist: Autochartist is a powerful tool available to Exness traders, providing automated chart pattern recognition and market analysis. It scans the markets for patterns and potential trading opportunities in real-time, allowing traders to act on emerging trends and setups. This tool also offers volatility analysis, giving insights into price movements and risk management.

- Trading Central: Exness partners with Trading Central, a renowned provider of market research and analytics, to offer comprehensive technical analysis. Trading Central provides insights on price trends, support and resistance levels, and potential entry and exit points. This tool is particularly useful for traders who rely on technical analysis but may lack the time to perform it independently.

- Economic Calendar: Integrated within both MT5 and the Web Terminal, the economic calendar provides up-to-date information on significant economic events, including central bank announcements, inflation reports, and employment data. This calendar helps traders stay informed about factors that may influence the market, allowing them to adjust strategies as needed.

- VPS Hosting: Exness offers Virtual Private Server (VPS) hosting for traders who require high-speed and stable connections, especially beneficial for those using automated trading systems. VPS hosting ensures faster execution speeds and minimal latency, a crucial factor for high-frequency traders and those relying on EAs for round-the-clock trading.

- Market News and Sentiment Analysis: Exness provides access to real-time market news and sentiment analysis, allowing traders to stay updated on global market events and shifts in investor sentiment. These insights help traders anticipate market movements, particularly when trading assets affected by news events or geopolitical developments.

Platform Accessibility and Device Compatibility

Exness’s platforms are designed to provide seamless access across multiple devices, ensuring that traders can monitor the markets and manage trades from anywhere. The following devices are supported:

- Desktop: MT4 and MT5 desktop applications provide full-featured trading capabilities, ideal for traders who prefer a comprehensive setup with advanced analytics.

- Mobile: Exness offers mobile trading applications for both MT4 and MT5 on iOS and Android. These apps provide essential trading features on-the-go, including charting, account management, and one-click trading.

- Web-Based Trading: The Exness Web Terminal, as well as web versions of MT4 and MT5, are accessible on any browser, allowing traders to execute trades and manage positions without the need for software installation.

Order Execution and Trade Management

Exness is known for its fast execution speeds, a critical factor for traders who rely on precise market entries, such as scalpers and high-frequency traders. The platforms support one-click trading and real-time trade management, allowing for efficient position handling. The order execution process is transparent and reliable, which is crucial in volatile market conditions where rapid price changes are common.

Risk Management Tools

To support effective risk management, Exness integrates several tools across its platforms:

- Stop Loss and Take Profit: These tools are standard features that help traders control potential losses and lock in profits by setting pre-defined exit points.

- Trailing Stop: Exness offers a trailing stop feature, allowing traders to move their stop loss along with market movements, which helps maximize profits while minimizing downside risk.

- Negative Balance Protection: Exness provides negative balance protection across all accounts, ensuring that traders do not lose more than their deposited capital even during high market volatility. This protection adds an extra layer of security, especially important for new traders or those using high leverage.

Spreads, Fees, and Commissions

Exness is known for its competitive pricing structure, which appeals to cost-conscious traders:

- Spreads: Exness offers tight spreads, often as low as 0.0 pips on certain accounts.

- Commission: While the Standard Account is commission-free, Raw Spread and Zero Accounts may have a small commission fee, making it transparent for traders preferring this structure.

- Swap-Free Option: Exness provides swap-free accounts, making it a suitable option for traders who wish to avoid overnight fees.

These low costs enhance the trading experience, allowing traders to keep more of their profits.

Customer Support and Service

Exness excels in customer support, providing 24/7 multilingual assistance via live chat, email, and phone. The support team is knowledgeable and prompt, ensuring traders receive reliable answers to their questions. Additionally, the website includes a comprehensive FAQ section and Help Center, making it easier for traders to find solutions independently.

User Experience and Education

Exness offers a user-friendly interface with intuitive navigation on all platforms, enhancing the overall user experience. While the broker provides some educational resources, including webinars and video tutorials, there is room for improvement. Beginners may benefit from more in-depth materials covering trading basics, strategies, and risk management.

Deposit and Withdrawal Methods

Exness supports a wide range of deposit and withdrawal methods, including:

- Bank Transfers: A reliable method, though it may incur longer processing times.

- Credit/Debit Cards: Widely accepted and convenient for most users.

- E-Wallets: Options like Neteller and Skrill offer instant processing, ideal for fast transactions.

- Cryptocurrencies: For those who prefer crypto, Exness supports payments in Bitcoin, adding an extra layer of convenience.

With minimal or no fees on most methods and fast processing times, Exness makes it easy for traders to manage their funds efficiently.

Conclusion

Exness stands out as a solid choice for traders due to its strong regulatory backing, competitive pricing, and extensive platform support. The variety of account types and platforms makes it accessible for both beginners and experienced traders. However, there is room for improvement in educational resources, and accessibility in restricted regions remains a limitation. Overall, Exness offers a well-rounded trading experience that is secure, flexible, and affordable, making it a popular choice in the forex industry.

⚠️ Risk Warning: Trading financial instruments such as forex, commodities, cryptocurrencies, and other derivatives on margin carries a high level of risk and may not be suitable for all investors. The possibility exists that you could sustain a loss of some or all of your invested capital, and therefore, you should not speculate with capital that you cannot afford to lose. Before deciding to trade with Exness, it is crucial to understand the associated risks and to seek advice from an independent financial advisor if necessary. Trading leveraged products amplifies the potential for both gains and losses, which can result in substantial financial damage in volatile market conditions. Exness provides risk management tools, but it remains the trader’s responsibility to utilize these tools effectively. Ensure you are fully aware of the risks involved in the financial markets and carefully consider your investment objectives, level of experience, and risk appetite before trading with Exness.